IT service provider ensures scalability of banking apps

Who is Swisscom?

Swisscom AG is the largest telecommunications company in Switzerland. It is also one of the leading Managed Service Providers (MSP) in the region. Swisscom’s IT infrastructure solutions enjoy a particularly good reputation in the ‘finance’ sector. Thanks to Swisscom’s services, finance enterprises can keep pace with market developments, while maintaining the highest security standards. Today, over 170 banks place their trust in Swisscom’s banking services. One of the foundations of this success is the continual expansion and improvement of its own range of services.

We manage over 500 user profiles with diverse approvals for monitoring. With Checkmk, their administration is child’s play.

Digitization increases demand for high performance banking systems

Financial companies are under great pressure when it comes to IT. Digital innovation is changing the competitive landscape, and factors such as a high-quality customer experience are seen as the foundation for business success. Banks and insurance companies, therefore, have a great interest in optimizing their IT infrastructure, since the continuous availability of IT resources with high performance is a basis for survival in the market.

All IT systems must at all times be securely protected against cyberattacks, and to also comply with strict legal requirements. An obvious option for the finance sector is therefore to outsource the hosting and operation of particularly important applications to specialized IT service providers. Swisscom Banking belongs to Swisscom AG and is one such expert, specializing in IT infrastructure services for finance companies.

One focus of the service offering is ‘Centralized Online Real-time Exchange Banking Systems‘ (CBS). These allow finance companies to make information about transactions available in a decentralized form for real-time processing. Swisscom was looking for an IT monitoring solution that would allow CBS and other IT assets to be monitored. The aim was to find a solution that could replace several other tools and was suitable for use in the managed service environment. This includes a secure separation of customer information and comprehensive scalability if, for example, a large number of new assets have to be included in the monitoring process within a short time frame.

At the same time, Swisscom Banking is bound by a wide range of regulations. For example, for security reasons, a CBS may not be operated as a cloud platform. It should therefore also be possible to set up monitoring on-premises. In addition, access from outside Swiss territory is not

permitted under any circumstances, as no data may leave the country.

The challenge

Swisscom was looking for a holistic IT monitoring solution that could easily replace the existing monitoring approaches, while at the same time being suitable for the development of diverse service products. In addition, the solution had to meet the security requirements expected of an IT financial services provider and have support facilities that could meet the needs of large companies.

Monitoring for managed services providers

Following a comprehensive evaluation, Swisscom Banking decided to use the Checkmk monitoring solution. Decisive factors were the resource-saving mode of operation, the ability to monitor heterogeneous systems, and the transparent billing on the basis of the number of measuring points used in monitoring. Another decisive point is the multi-client capability, which allows the administration team to precisely control the access rights for internal and external users.

At the heart of the monitoring are the computer centers which Swisscom Banking operates as the basis for its Managed IT Services. The hardware is based on mainframes running AIX or Solaris as operating systems. The MSP can monitor all systems via the supplied Checkmk agents.

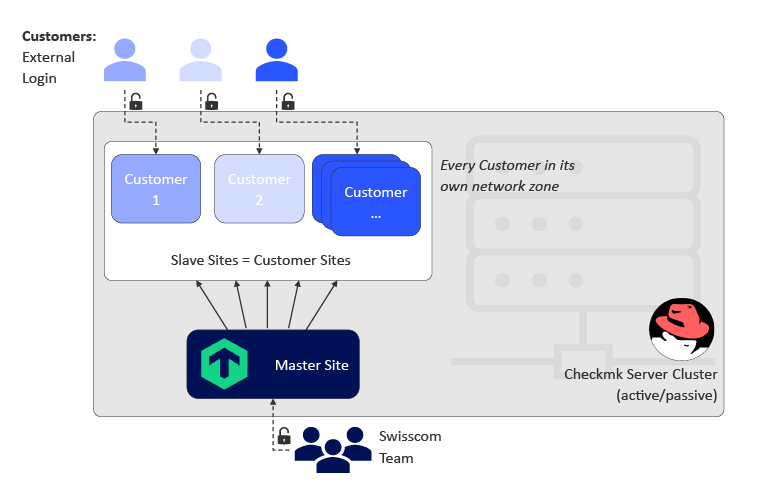

Swisscom customers usually book monthly adaptable infrastructure plans with targets for CPU, RAM, and hard disk space. According to these bookings, Swisscom Banking partitions an LPAR segment in their computer center and allocates the agreed resources to the customer. The IT team also creates a Checkmk remote site in the customer’s environment. The IT team then manages this via a Checkmk central site, which it sets up in the same computer center.

All Checkmk instances run on high availability Red Hat server clusters (active/passive). Swisscom Banking’s IT specialists then set up the desired servers and systems in the customer segments. CBS usually rely on large Oracle databases. The monitoring experts at Swisscom Banking wrote their own checks for the Checkmk Oracle plug-in so as to optimize data evaluation.

The solution

Swisscom Banking decided to collaborate intensively with Checkmk, and the software was expanded in many sectors in accordance with Swisscom Banking’s requirements. This enables Checkmk to support Swisscom, for example, in the auditing of the services provided to Swisscom customers. In addition, a capacity management function would be developed for Swisscom Banking.

Scalability is key

The demands on monitoring are high, with some individual hosts creating thousands of services. Swisscom and the Checkmk team adapted Checkmk appropriately so that it can now clearly display even the most demanding environments in monitoring. Swisscom Banking has presented the specific details of Oracle monitoring in a presentation at the Checkmk Conference 2020. Currently, Swisscom Banking monitors more than 1,800 hosts and 175,000 services in over 20 Checkmk instances. One host can have up to 30 databases and 30,000 services. Due to its flexibility, Checkmk is able to monitor all of these systems.

The monitoring also includes all information on CPU, RAM, and the hard disk space of the database servers. Swisscom adapts the monitored metrics and dashboards exactly to the customer’s requirements. Special requests from customers such as customized reports can also be handled easily with Checkmk. All analyses are carried out on-premises, and no monitoring data has to leave the data center. Nevertheless, the customers always have a comprehensive insight into their assets.

The advantages

With the help of Checkmk, Swisscom Banking has improved both the quality and the range of its services. The capacity management option, in particular, is a unique selling point and it enables customers to assess their needs precisely. Checkmk is much more than just a monitoring tool and in this way, it creates great added value for Swisscom Banking.

Highly precise capacity management as a service

In 2020 Swisscom Banking expanded its service portfolio into the area of capacity management with Checkmk. To this end, a number of mathematical procedures were integrated into Checkmk for the purpose of producing accurate forecasts for Swisscom’s customers.

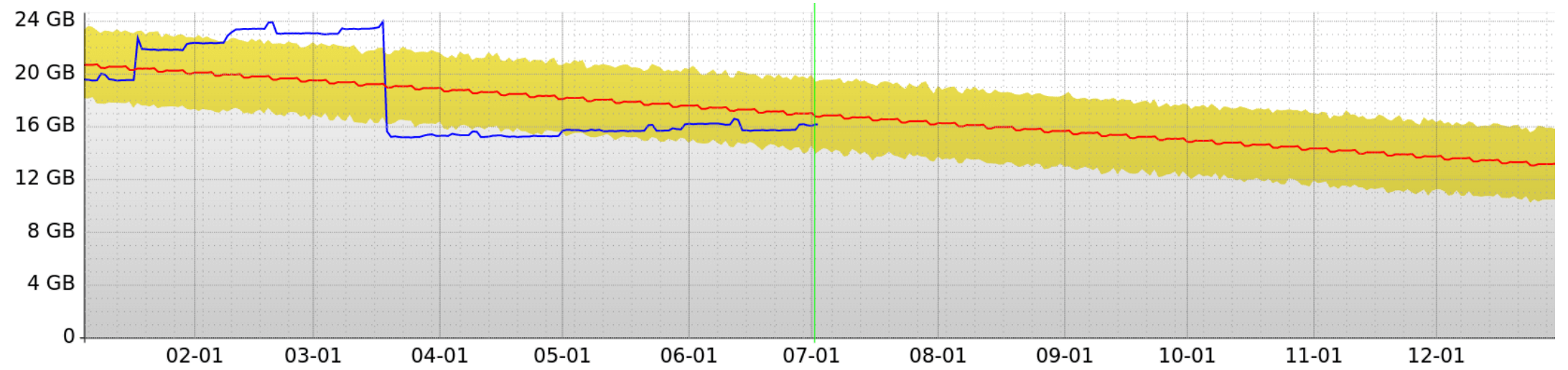

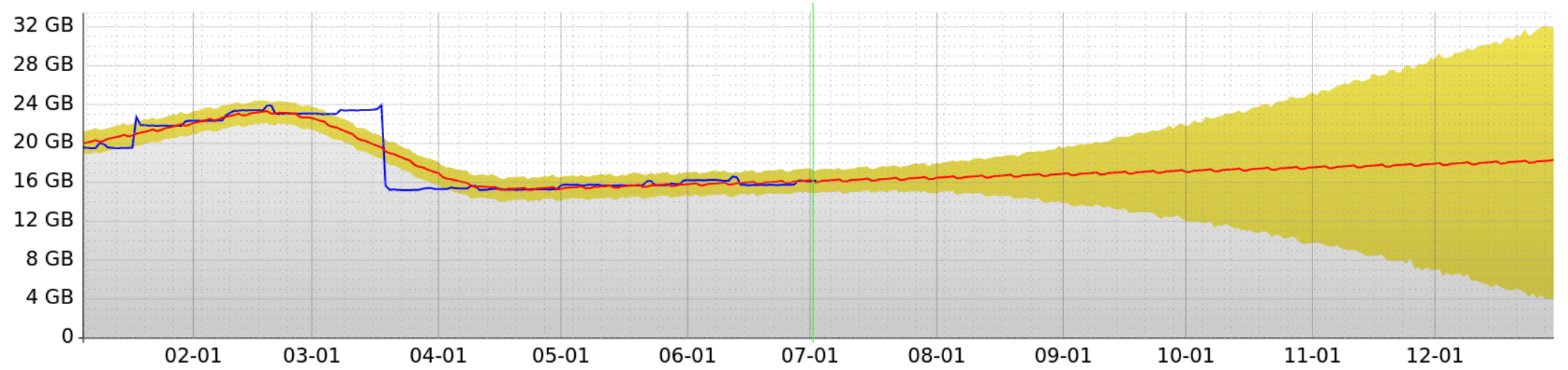

The result is the new Forecast Engine. A comparison of the figures below shows the improvement in results over a period of several months due to the new analysis capabilities. The screenshots from Checkmk use the same measured values for the utilization of a file system over the same period of time. The blue line in both diagrams shows the previously measured values. The only difference is the use of the mathematical procedures to generate the forecast (red line).

In the first graph, a simple linear interpolation is used to approximate a function to the real measured values. This method is not suitable for a precise forecast because the one-off increase in memory requirements in mid-March and the subsequent growth in available memory has not been correctly interpreted. Instead, the forecast is distorted and a growing memory requirement is predicted.

The second graph shows the new mechanisms in action. These allow a better approximation of the forecast to the real measured values and thus revise the forecast. In this case, the Swisscom customer benefits from the new accuracy. Further details on the function of the new integration can be found in the Checkmk manual or in the blog post on this subject.

With Checkmk we can provide real-time insight. Among other things, we can combine inventory and status data in a single view and show the customer exactly how his applications are performing.

Swisscom Banking would like to automate further processes with Checkmk and to expand the insights for its customers. Checkmk can process and visualize a large volume of information. Through the increased integration of Checkmk, Swisscom Banking is able to improve its service quality and plans, for example, to provide more real-time analysis for its customers.